Know the Tariff and Definition of 'Airport Tax'?

Airport Tax is a type of tax that is charged to passengers when they are at the airport. In the past, this airport tax was levied separately on prospective airplane passengers.

However, in 2015 the Ministry of Transportation (Kemenhub) imposed a new rule, namely that the payment of airport tax or airport tax will be included directly in the price of tickets sold by each airline.

The policy of incorporating airport tax fees into the ticket price is considered more practical and will make passengers feel more comfortable. Especially for those who are in a hurry to catch a flight.

Get to know 'Airport Tax'

Broadly speaking, airport tax or Passenger Service Charge (PSC) or commonly called Aircraft Passenger Service (PJP2U) is a fee for aircraft passenger services at the airport.

Biaya ini terhitung sejak mereka memasuki bandara (curb), beranda keberangkatan (departure), pintu keberangkatan, hingga pintu kedatangan (arrival) dan bandara kedatangan.

The implementation of the airport tax is driven by a number of services and facilities launched by PT Angkasa Pura II, including skytrains and other high technology-based supporting facilities at airports and terminals such as:

- Check in me

- Vending machine

- Digital information

- Baggage handling system

- Flight information display system

- Ground support system

- Up to the visual docking guide system

The launch of these facilities certainly aims to provide more comfort and convenience for passengers.

Benefits of Implementing 'Airport Tax'

The implementation of an airport tax certainly has several perceived benefits for passengers and airport managers.

One of them is airport tax can increase and improve public facilities at airports.

With the better facilities at the airport, the passengers will also feel comfortable.

Furthermore, airport taxes are also useful as insurance costs for airport visitors.

Regarding the guarantee of the safety of the passengers, of course, it is not something that can be taken lightly and really needs to be considered.

Not only that, airport taxes are also useful for airport maintenance costs. In order to ensure operational readiness and passenger safety, maintenance costs are required for every aspect at the airport.

Airport taxes are also useful for increasing the quality of the airport management's human resources , so that all flight-related activities can run well and optimally.

Illustration of Soekarno-Hatta airport

Illustration of Soekarno-Hatta airport

Who Is Subject to the 'Airport Tax'?

Apparently, not all passengers at the airport will be subject to airport tax .

There are those who are obliged to pay this airport tax and there are also passengers who are not subject to airport tax , who are they?

a. Passengers Charged 'Airport Tax'

There are two types of passengers who are subject to airport tax , namely:

- Passengers who fly for only one trip use one ticket according to the destination airport.

- Air operations personnel and flight operations support personnel who travel for positioning in carrying out their duties.

b. Passengers Not Subject to Airport Tax

The following are a number of passengers who are not required to pay airport tax:

- Aircraft operations personnel and flight operations support personnel who are on duty ( on duty crew ).

- Passengers who transit and transfer with 1 flight ticket.

- Airplane passengers who experience a diversion of flight departures from the airport listed on the ticket (divert flight).

- State guests and entourage who are on official visits or on state affairs in Indonesia and use special aircraft.

- Infants or child passengers who are still not required to have a ticket with their own flight seat number.

- Airplane passengers who experience flight departure delays.

- Passengers who fly overseas through a series of domestic routes and carry out customs, immigration and quarantine (CIQ) processes at the first departure airport are not subject to PSC at the transit airport.

Illustration of airport tax fare or airport tax

Illustration of airport tax fare or airport tax

Big Airport Tax

Each airport or airport certainly has its own airport tax rate, including Soekarno-Hatta Airport.

In March 2018, the Ministry of Transportation increased the airport tax rate at some of these airport terminals, which is set at 15% to 40%.

This tariff increase is regulated in the Letter of the Minister of Transportation Number PR 303/1/1/PHB of 2018 concerning Aircraft Passenger Services.

So, how much is the airport tax fare ? Here's the list:

- Terminal 1, the airport tax rate increased by 30% from the previous IDR 50,000 to IDR 65,000 per passenger.

- Domestic Terminal 2, airport tax rates increased by 40% from the previous Rp60,000 to Rp85,000 per passenger.

- For International Terminal 3, the airport tax rate has increased by 15% from the previous Rp. 200,000 to Rp. 230,000 per passenger.

- Domestic Terminal 3, the airport tax rate does not increase, it remains at Rp. 130,000.

That is the amount of airport tax rates that apply at Soekarno-Hatta Airport so far.

By understanding this airport tax, you realize the importance of collecting airport facilities and you have the right to make the most of it.

Sebagai warga negara yang juga Wajib Pajak (WP), Anda memiliki kewajiban lain atas perpajakan kepada negara untuk bisa mendapatkan fasilitas umum yang lebih baik lagi.

Therefore, pay your taxes according to the obligations attached to you and report the taxes you have paid according to the specified deadline.

Illustration of Indonesian citizens and people who are entitled to enjoy public facilities from paid taxes

Illustration of Indonesian citizens and people who are entitled to enjoy public facilities from paid taxes

Pay Your Tax Liability the Easy Way

To make it easier to pay taxes and report your Annual Tax Return (SPT), do it online by utilizing cloud computing technology .

Cloud is a technology that makes the internet a central server for managing data and user applications.

Through cloud technology, you can use the application without having to download and install the application first.

Because this cloud system is web-based ( Web Based ) which makes it easy to access data and information via the internet quickly.

Because Klikpajak uses a cloud system . The technology you need for smooth taxation activities.

Klikpajak is the official partner of the Directorate General of Taxes (DGT) as a Tax Application Service Provider (PJAP) or Application Service Provider (ASP) which is legalized by the Director General of Taxes Decree Number: KEP-169/PJ/2018.

Illustration of cloud technology security system must meet international standards

Illustration of cloud technology security system must meet international standards

Data Security

Klikpajak.id is a web-based tax application that can store various payment histories or proof of tax reporting and other tax activities that you do safely.

So you don't have to worry about losing proof of payment or missing tax reports if there is damage or loss of a computer or laptop.

You can also do tax matters anytime and anywhere and use any device with only an internet network.

Anda dapat nyaman menggunakan aplikasi Klikpajak karena keamanan dan kerahasiaan data terjamin.

Because Klikpajak has been certified ISO 27001 from the ISO International Standards Agency which guarantees the security standards of information technology systems.

Examples of complete features of the Klikpajak online tax application

Examples of complete features of the Klikpajak online tax application

Complete Features of Klikpajak

“Klikpajak is here to provide tax solutions for business actors, tax consultants, or those of you who work in the finance department or as a tax officer in a company. With complete features, Klikpajak is designed to meet your needs in carrying out tax activities.”

What are the complete features of Klikpajak that make it easier for you to carry out tax activities?

e-Filing Klikpajak

You will find it easy to report your Annual/Tax Period SPT using the Klikpajak e-Filing application because it will be guided by easy steps.

In addition, reporting all types of SPT via e-Filing Klikpajak is free forever and can be done anytime and anywhere, such as:

- Annual Corporate Tax Return (SPT)

- SPT Period (Monthly) Tax

- Annual Personal Tax Return

After submitting the Tax SPT, you will receive a proof of report in electronic form, namely the Electronic Proof of Receipt (BPE) from DJP, which contains:

- Taxpayer Name Information (WP)

- Taxpayer Identification Number (NPWP)

- BPE creation date

- BPE creation hours

- Electronic Receipt Number (NTTE)

Through Klikpajak, you will also get an official NTTE from the DGT as proof of the report.

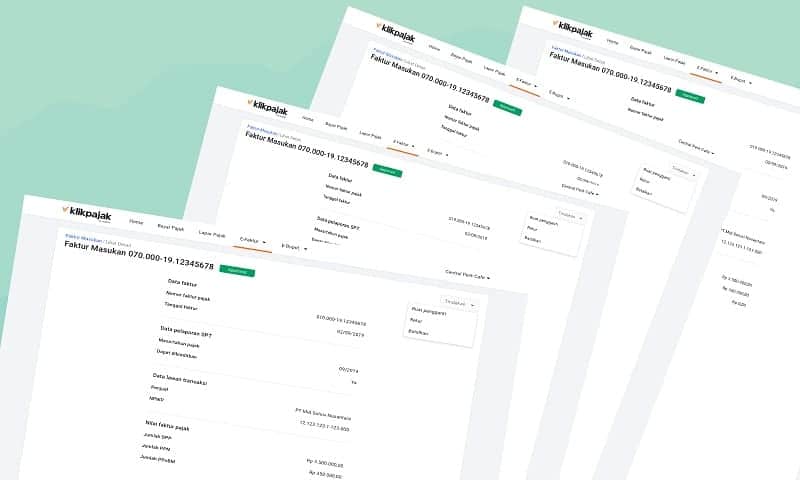

Clickpajak e-Invoices

Through Klikpajak, you can easily manage tax administration starting from:

- Input Tax Invoice

- Output Tax Invoice

- Making Tax Return Invoice

- Manage Input, Output, and Return Tax Invoices

You will be guided with easy and simple steps to use the e-Invoice feature.

The Klikpajak e-Faktur feature also makes it easier for you to manage your Tax Invoice Serial Number (NSFP) and obtain a VAT (Value Added Tax) Notification Letter according to the data uploaded to the DGT.

Example of creating an Input Tax Invoice in Klikpajak e-Faktur

Example of creating an Input Tax Invoice in Klikpajak e-Faktur

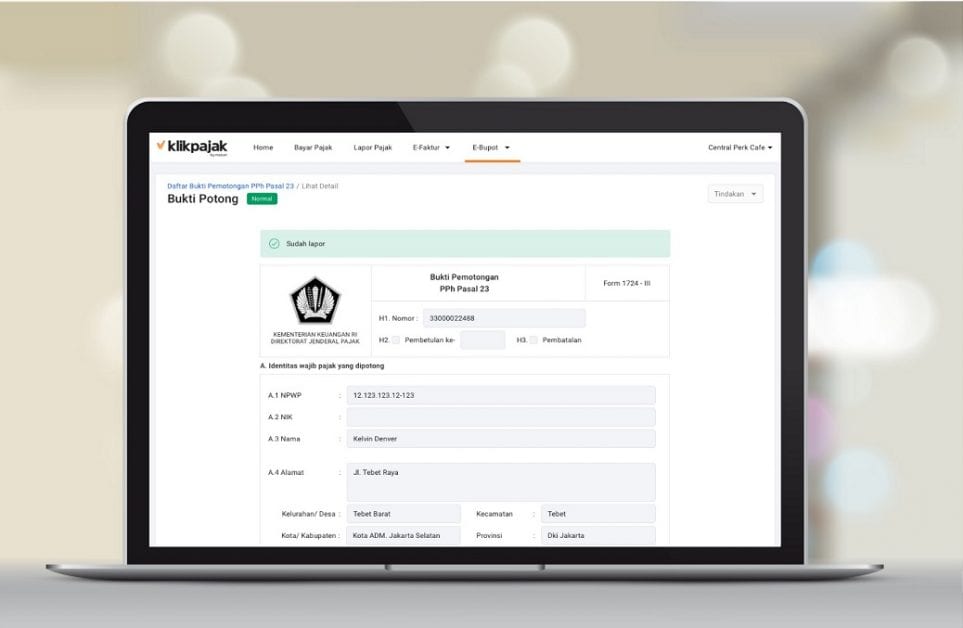

e-Bupot Klikpajak

Klikpajak is also equipped with an e-Bupot feature that makes it easier for you to publish Withholding Evidence and manage large amounts of withholding evidence more easily. Because the flow is efficient and user friendly .

As is known, through the Decree of the Director General of Taxes Number KEP-269/PJ/2020, starting August 1, 2020, every Taxable Entrepreneur (PKP) who has been registered with the Pratama Tax Service Office (KPP) throughout Indonesia is required to make proof of tax withholding and report a period SPT. PPh Article 23 and/or Article 26 electronically through the e-Bupot application.

Now, the mandatory implementation of e-Bupot nationally takes effect from September 1, 2020 through KEP-368/PJ/2020 which states:

"All taxpayers who have complied with the provisions of Article 6 of PER-04/PJ/2017 are immediately required to make an Article 23/26 income tax return and make evidence of withholding electronically through e-Bupot starting September 2020."

Advantages of e-Bupot Klikpajak

e-Bupot Klikpajak has advantages that you can use to help the company's business, including:

- Management of bulk proof cuts is easier due to the efficient and user friendly manufacturing flow.

- Automatic tax calculation on SPT Period PPh 23/26.

- Sending proof of tax withholding directly to the counterparty.

- The proof of withholding and reporting of the 23/26 PPh Period SPT does not need to be signed with a wet signature.

- e-Bupot Klikpajak also has performance that can be scaled up as needed.

- Reliable tax support services and tutorials on using the application that are constantly updated.

- The Klikpajak e-Bupot feature also provides data for the need for recapitulation and reconciliation of tax invoice data for transactions made.

Example of the feature of making proof of income tax withholding 23/26 in e-Bupot Klikpajak

Example of the feature of making proof of income tax withholding 23/26 in e-Bupot Klikpajak

e-Billing Klikpajak

The e-Billing system will guide you in filling out the electronic Tax Deposit Letter (SSP) correctly according to the transaction.

Before depositing taxes, you need to get a Billing Code or Billing ID first from the DGT via e-Billing.

Anda bisa membuat ID Billing untuk semua jenis Kode Akun Pajak (KAP) dan Kode Jenis Setoran (KJS) dengan mudah dan gratis.

All history of Billing ID and SSP will be stored safely according to the type and desired tax period.

Likewise, the State Revenue Transaction Number (NTPN) will be stored neatly and securely in the Tax Archive at Klikpajak.

Example of billing code issued by Klikpajak

Example of billing code issued by Klikpajak

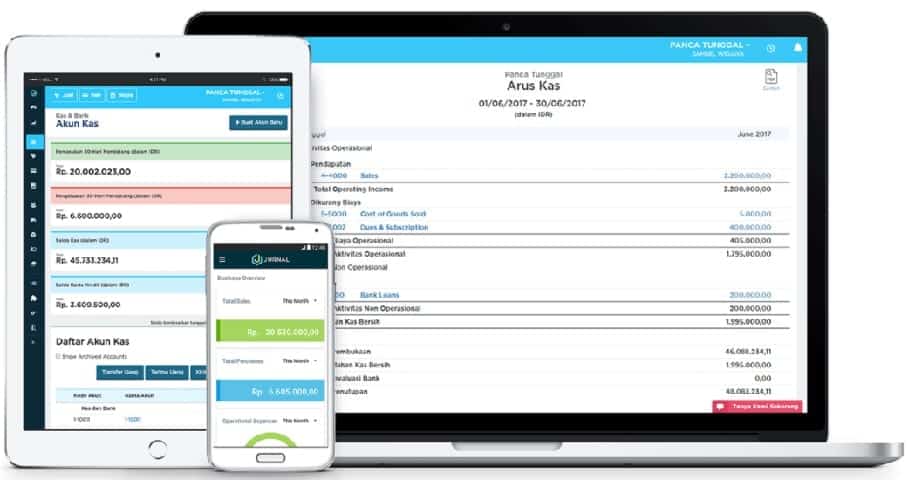

Integrated with 'Online' Accounting Applications

Another advantage of Klikpajak is that it can pull data directly from the financial reports of users of the online accounting application Jurnal.id.

You will find it easier to create and manage e-Faktur and e-Bupot because Klikpajak can pull data directly from the financial reports of users of online accounting applications such as Jurnal by Mekari – Simple Online Accounting Software .

This is an advanced technology based on API integration that makes processing tax data from the accounting (finance) department faster and easier.

So that the tax management process becomes easier and more precise only with Klikpajak.

An example of the online accounting feature of Jurnal.id which is integrated with the online tax system support Klikpajak.id

An example of the online accounting feature of Jurnal.id which is integrated with the online tax system support Klikpajak.id

Klikpajak 'Support' Team is Ready to Help You!

As an official DGT partner, Klikpajak will assist you in calculating, paying and reporting tax activities. Just a click, all your tax matters are done in an instant!

Want to see how Klikpajak can help your business in making Tax Invoices, Proof of Withholding Taxes, submitting Periodic VAT Returns and other tax activities effectively that can save you a lot of time?

“We enjoyed talking to you. Schedule a demo and we can show you how. Klikpajak understands what you need.”

Simply register your email at www.klikpajak.id and take advantage of the convenience in managing your taxation from calculating, paying to reporting taxes in just one platform.

0 Response to "Know the Tariff and Definition of 'Airport Tax'?"

Posting Komentar